2290 heavy use tax 345189-2290 heavy use tax 2020

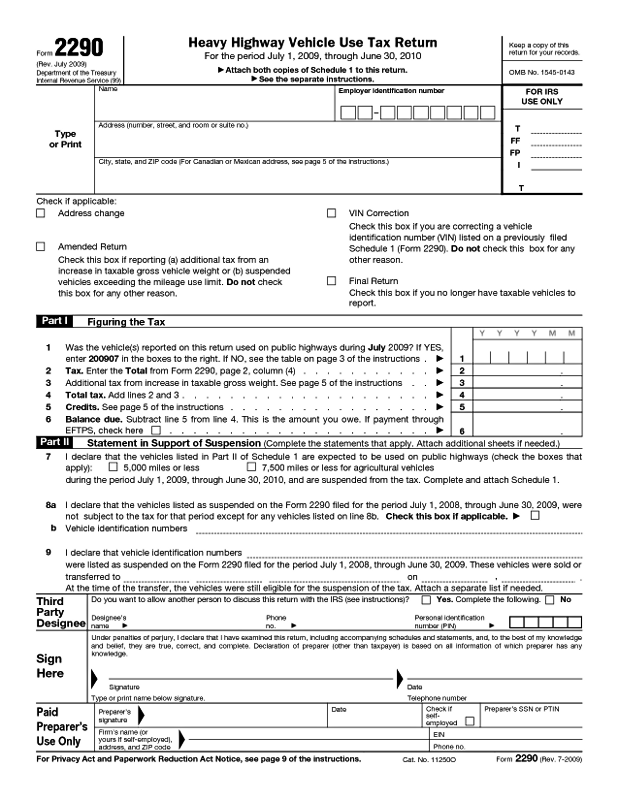

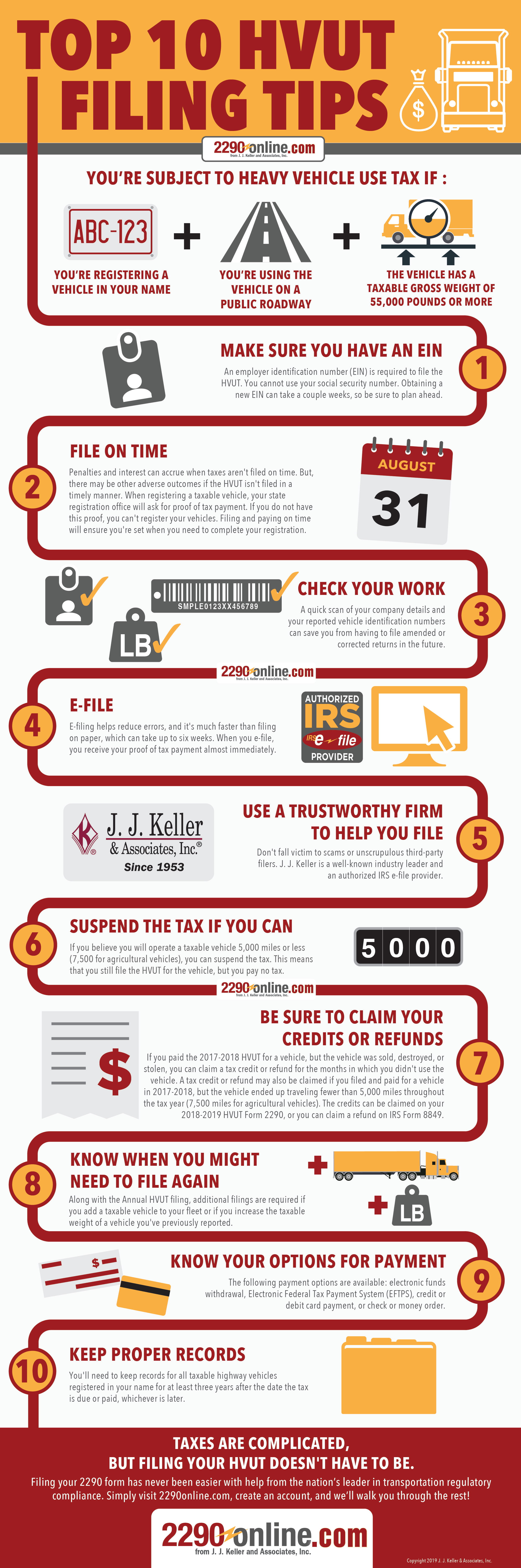

Federal Heavy Highway Vehicle Use Tax Form 2290, Online reporting Efiling can secure you IRS Stamped Schedule1 Proof in minutes Every trucker operating a heavy highway vehicle may be an individual, or a limited liability company (LLC), or a corporation, partnership firm, or any other type of organization (including nonprofit, charitable, educational, etc) need to report 2290 Truck TaxJul 01, 21 · Heavy vehicle use tax (HVUT) is applicable to those vehicles which operate on public highways and have a gross taxable weight of 55,000 pounds or more It is collected each year and used for things like highway construction and maintenance Form 2290 is also used for reporting any vehicles which are expected to be used within 5,000 miles orHVUT, Heavy Vehicle Use Tax is a federal excise tax paid by the truck owners annually on heavy vehicles whose gross weight of 55,000 pounds and more Interstate and intrastate registered vehicles pay 2290 truck tax The American Association of State Highways Official discovered the Heavy Vehicle Use Tax filing since late 90's as the heavyweight trucks caused damages to the

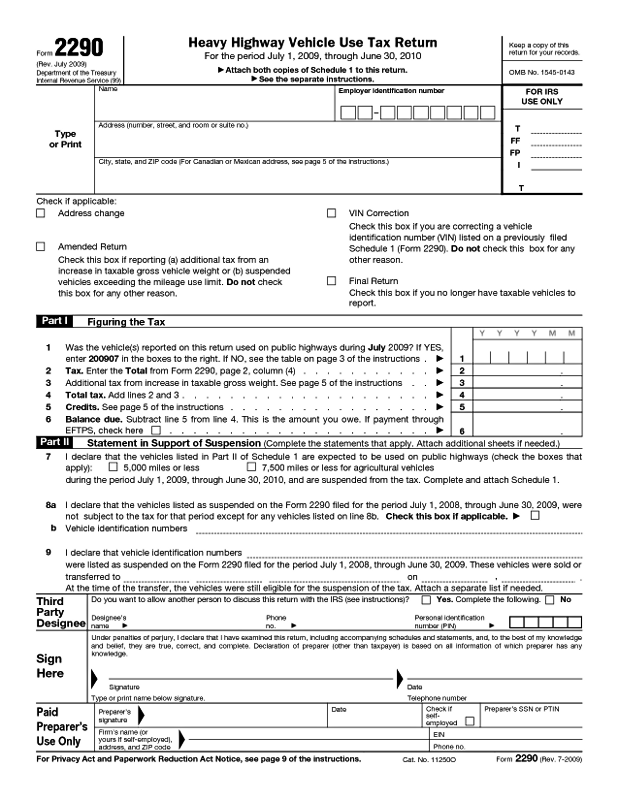

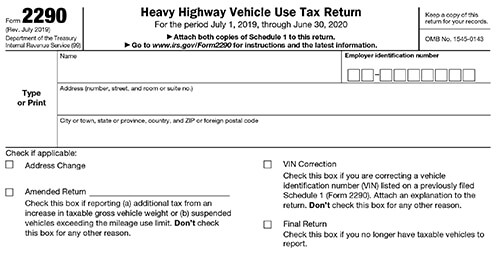

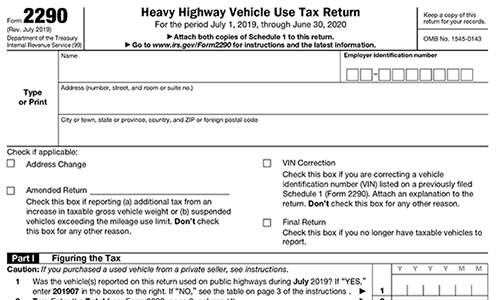

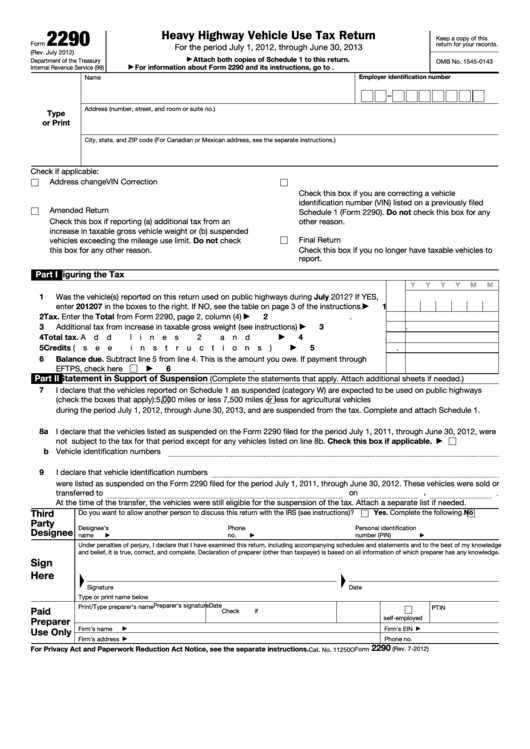

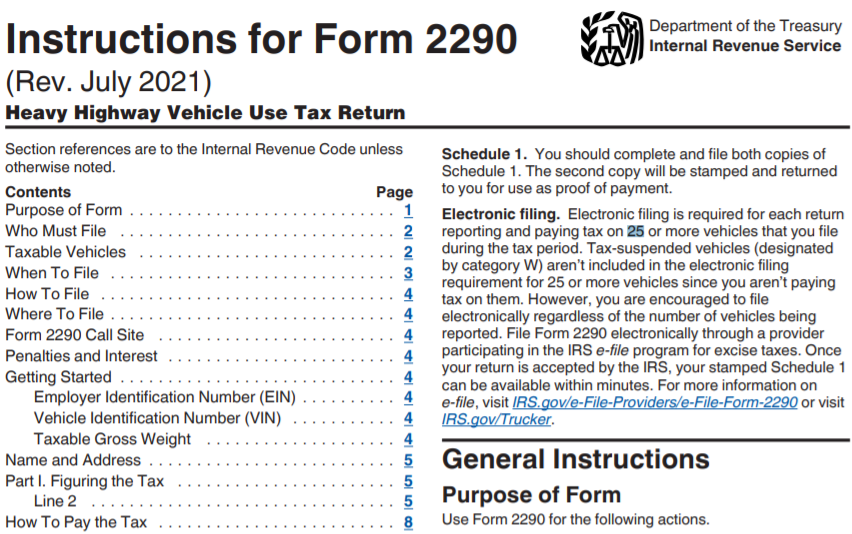

Form 2290 Instructions In Normal People Language

2290 heavy use tax 2020

2290 heavy use tax 2020-File IRS form 2290 online in minutes Get your 2290 form, e file and stamped schedule 1 from the leader in heavy vehicle use tax filiings 100% American Owned & OperatedThe Federal Heavy Vehicle Use Tax (HVUT) is required and administered by the Internal Revenue Service (IRS) Federal law requires proof that the HVUT tax was paid when you register a vehicle that has a combination or loaded gross vehicle weight of 55,000 pounds or more

Irs Gives Truckers Three Month Extension Highway Use Tax Return Due Nov 30 Clarksville Tn Online

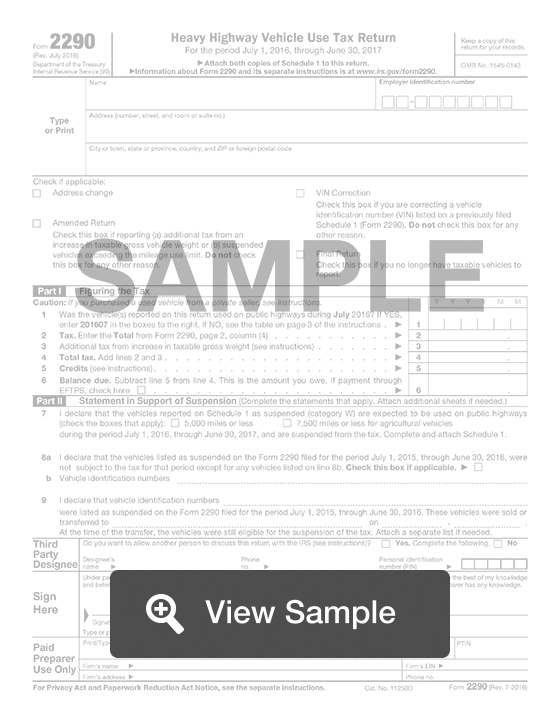

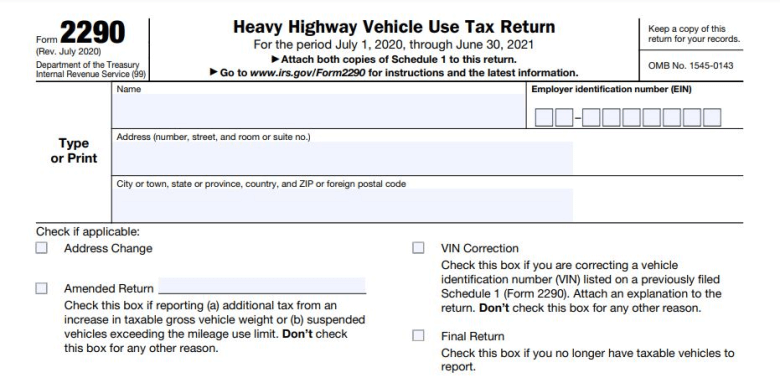

Form 2290 is an IRS tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more The IRS mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due date This tax form goes by many names like HVUT (Heavy Vehicle Use Tax), heavy highway taxJun 25, 21 · Information about Form 2290, Heavy Highway Vehicle Use Tax Return, including recent updates, related forms, and instructions on how to file Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles2 efile Form 2290 To efile Form 2290 with 24 or fewer vehicles, use our efile Online Now process Or, if you have more than 25 vehicles, use our Free Heavy Vehicle Use Tax Calculator a unique excel spreadsheet used to precalculate taxes and credits and then (after the hard work is done!) bulk upload your data so you don't have to retype any input

2290 Taxcom, we make it easy to file form 2290 Heavy Vehicle Use Tax – guaranteed Our Family Company 2290 Taxcom is an established family owned business and has been active in the trucking industry since 1934 Our family has always strived to serve clients with superior service Get StartedHeavy Vehicle Use Tax Form 2290 HVUT2290 FOR July June 21 PERIOD SUPPORT / QUESTIONS?What is the Heavy Highway Vehicle Use Tax Form 2290?

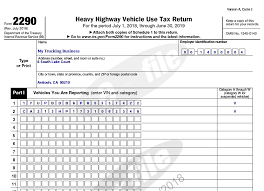

Form 2290 filing is required if the truck has a gross vehicle weight (GVW) of 55,000 pounds or more and the truck is used on a public highway If you have a truck you use for 5,000 miles or less 7,500 for farm trucks you are required to file an HVUT return, but you won't need to pay the heavy vehicle use tax Start Filing My 2290Form 2290, heavy vehicle use tax return is used to figure and pay taxes for the vehicles with the taxable gross weight of 55,000 pounds or more Form 2290 is also required when the acquisition of used vehicles is done for the current tax periodWhat is IRS Form 2290?

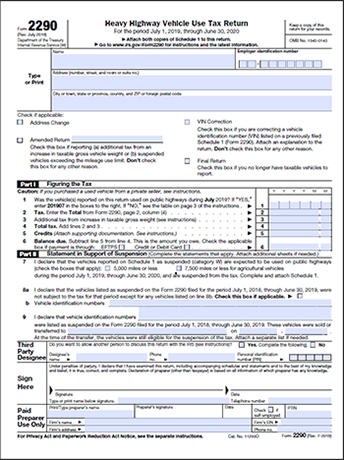

Heavy Highway Vehicle Use Tax Return Free Download

1

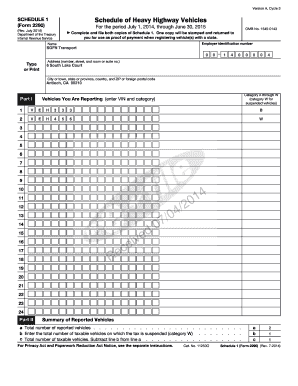

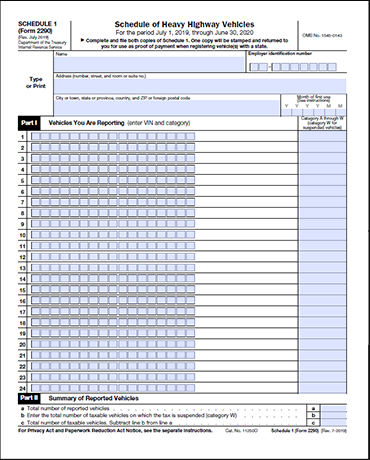

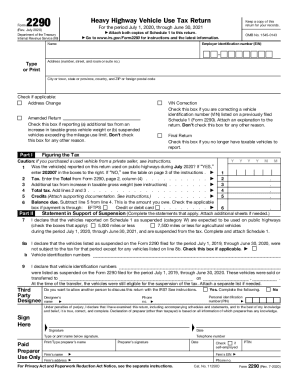

The full HVUT Return Form 2290 (include pages Heavy Highway Vehicle Use Tax Return, Tax Computation, Schedule 1, Consent to Disclosure of Tax Information, and the Payment Voucher pages) without the IRS PAID or RECEIVED stamp but accompanied by aThe Heavy Highway Vehicle Use Tax or HVUT 2290 is a federal tax imposed on vehicles with a taxable gross weight of 55,000 pounds or more The taxable gross weight is the actual weight of the vehicle that is fully equipped for service without loadYou must file Form 2290 and Schedule 1 for the tax period beginning on July 1, 21, and ending on June 30, 22, if a taxable highway motor vehicle (defined below) is registered, or required to be registered, in your name under state, District of Columbia, Canadian, or Mexican law at the time of its first use during the period and the vehicle has a taxable gross weight of 55,000 pounds or more

Heavy Highway Vehicle Use Tax Form 2290 Online Florida Truck Tax

1

This website is very easy to use to file form 2290 (Heavy Vehicle Highway Use Tax) It is a very efficient way of filing this form and takes a short time to file to the government Our stamped receipts from the IRS for Form 2290 are available to us in a very timely mannerJun 30, 21 · The dog days of summer are a reminder that it's time to file your Form 2290 heavy vehicle use tax (HVUT) for the upcoming tax year The HVUT applies to trucks and buses used on the highway with a taxable gross weight of 55,000 pounds or more Any vehicles registered in the US, Canada, and Mexico are subject to the taxGenerally, you must file Form 2290, Heavy Highway Vehicle Use Tax Return, and pay the appropriate tax if you are registering in your name a heavy highway motor vehicle with a gross weight of 55,000 pounds or more Taxpayers generally must present the IRSreceipted Form 2290, Schedule 1, or a

Irs Truckers Should E File Highway Use Tax Return By September 3 Alaska Business Magazine

1

The Heavy Vehicle Use Tax (HUT, or HVUT), IRS Form 2290, is a federal requirement pertaining to and required of all entities operating vehicles over 55,000 pounds under aTax 2290 Electronic Filing 100% Secured Electronic filing is The Best way of reporting your Federal Heavy Highway Vehicle Use Tax Returns with the IRS Available 24X7, choose eFile and ease your 2290 tax reporting!IRS Form 2290 is used to file the Heavy Vehicle Use Tax (HVUT) The annual tax period starts on July 1st If a heavy vehicle is used in any month for the first time in that tax year, then HVUT must be filed with IRS by end of the following month warren2290com can help you efile Form 2290 with IRS

Form 2290 An Overview Due Date Filing Methods Mailing Address

Form 2290 Instructions In Normal People Language

The heavy highway vehicle use tax is a fee assessed annually on vehicles that operate on public highways with registered gross weights of 55,000 pounds or more The weight includes the motor vehicle, any trailers and the maximum load carried by the trucktrailer combinationIrs form 2290 Now accepting prefilings for 21 period The Heavy Vehicle Use Tax is filed to IRS annually and is required to be filed by companies and owneroperators which operate vehicles equal to or greater than 55,000 poundsCall help@2290info chat wwwdotsosus THE Highway Use Tax, Form 2290 (JULY JUNE 21) FILING PERIOD JULY JUNE 21 DEADLINE AUGUST 31, 21 33 W Higgins Rd Ste 810 South Barrington IL

Irs Form 2290 Heavy Highway Vehicle Use Tax Form 2290

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return Printable Pdf Download

Owners who need a Form 2290 for submitting their Heavy Vehicle Use Tax to the IRS can acquire forms from the IRS website at IRS Forms and Instructions Index If you have any questions about the Heavy Vehicle Use Tax, contact a local Internal Revenue Service officeWhat is IRS Form 2290?Quickly efile IRS Form 2290 with ExpressTruckTax and receive your stamped Schedule 1 within minutes Get automatic updates via email or text Get Schedule 1 via email, fax, or mail We will even notify your company/carrier automatically

Form 2290 Online Truckdues Com To E File Vehicle Use Tax Starts From 7 99

Irs Form 2290 E File What Is It E File Irs Form Federal Tax Forms Hvut 2290 Form 1099 Form

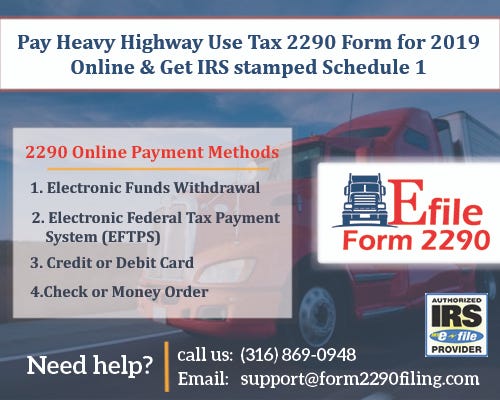

Jul 02, 21 · Asked on Monday if the 21 list was a work in progress given the 2290 tax season was just getting under way, Southwell noted "we continually update the web page as new content becomes availableJun 30, 11 · Use Form 2290V, Payment Voucher, to accompany your check or money order Form 2290V is used to credit your heavy highway vehicle use tax payment to your account If filing electronically, see How To Pay the Tax, laterPay 2290 Heavy Vehicle Use Tax & Get IRS Stamped Schedule 1 within Minutes File Form 2290 to pay 2290 Heavy Vehicle Use Tax If you wish to File 2290 Online, quickly start Filing HVUT 2290 with form2290filingcom Within the Form 2290 Due Dates, file IRS 2290 Online to avoid penalty

Highway Use Tax 2290 800 498 90

Download Irs Form 2290 Heavy Highway Vehicle Use Tax Return

Apr 29, 21 · 2290 Heavy Vehicle Use Tax is an annual tax imposed on heavy vehicles that uses public highways with 55,000 pounds or more The highway taxes are fixed on heavy vehicles by taking gross weight into consideration In general, commercial vehicles and agricultural vehicles which use highways for transportation pay 2290 taxIRS Form 2290 is used to file the Heavy Vehicle Use Tax (HVUT) The annual tax period starts on July 1st If a heavy vehicle is used in any month for the first time in that tax year, then HVUT must be filed with the IRS by the end of the following month TPE2290com can help you efile Form 2290Aug 06, 19 · Taxpayers who must pay the heavy highway vehicle use tax should remember they can file and pay electronically While some taxpayers who file Form 2290 are required to file electronically, all 2290 filers can do so

Irs Gives Truckers Three Month Extension Highway Use Tax Return Due Nov 30 Clarksville Tn Online

Www Dot Nd Gov Divisions Mv Docs 2290filinginstructions Pdf

We're real people just like you!Form 2290 Tax Computation Table You can determine your tax amount by referring to the table below Gross Taxable Weight Heavy Vehicle Use Tax Rates/ per vehicle Less than 55,000 lbs No tax 55,,000 lbs $100 plus $22 per 1,000 lbs over 55,000 lbsIRS Form 2290 is used to file the Heavy Vehicle Use Tax (HVUT) The annual tax period starts on July 1st If a heavy vehicle is used in any month for the first time in that tax year, then HVUT must be filed with IRS by end of the following month

Fillable Online Taxboard Form 2290 Ez Heavy Highway Vehicle Use Tax Return For Filers With A Single Vehicle Rev Taxboard Fax Email Print Pdffiller

I R S F O R M 2 2 9 0 Zonealarm Results

Quickly efile your IRS 2290 Form for Heavy Vehicle Use Tax (HVUT) If you've filed your IRS Form 2290 by mail in the past, you know it took weeks to receive your stamped Schedule 1 With the 2290onlinecom Service, the filing process can be completed in minutes, and you can have your Schedule 1, with electronic stamp, in as little as 24 hoursFast and Easy 2290 Heavy Vehicle Use Tax (HVUT) Filing If you have any vehicles 55,000 pounds or more, J J Keller's 2290onlinecom is the fastest way to e‑file IRS Form 2290 (Heavy Vehicle Use Tax) and get your stamped Schedule 1 — which is used as proof of payment to annually register your vehicles with your stateFederal Heavy Vehicle Use Tax All applicants for registration of a vehicle with a declared gross vehicle weight of 55,000 pounds (28 ton) or more must present proof of payment of Federal Heavy Vehicle Use Tax imposed by the Internal Revenue Code, 26 USC 4481, to the County Treasurer before the vehicle can be registered

Form 2290 Reporting For 19 8 Tax Year Irs Truck Tax Form 2290

Heavy Highway Vehicle Use Tax Form 2290 Lovely Form Line Cropped Filing E W10 Phenomenal 2290 Models Form Ideas

The IRS Tax Form 2290 to report and pay the federal heavy highway vehicle use taxes can be filed online at TaxExcisecom and Tax2290com, the first ever IRS Authorized Efile service provider for 2290 HVUT returns Top rated, inexpensive, market leader and truckers and owner operators first choice for 2290 electronic filing #2290efiling #tax2290 @taxexciseForm 2290, the heavy highway vehicle use tax returns are reported for 12 months period from July 21 through June 21 At Tax2290com we're accepting prefiling for the 2290 taxes, prefiling is advancing your 2290 preparation and receive the IRS Watermarked Schedule 1 proof copy on the first day when your returns is processedComplete Form 2290V if you are making a payment by check or money order with Form 2290, Heavy Highway Vehicle Use Tax Return We will use Form 2290V to credit your payment more promptly and accurately, and to improve our service to you

2290 Heavy Highway Use Tax

Http Www Scdmvonline Com Media Forms I2290 Ashx

Complete Form 2290V if you are making a payment by check or money order with Form 2290, Heavy Highway Vehicle Use Tax Return We will use Form 2290V to credit your payment more promptly and accurately, and to improve our service to youFile Form 2290 which is your Heavy Vehicle Use Tax (HVUT) Return with IRS trusted efile 2290 provider Grab upto 75% off on filing 2290 online & get schedule 1 in minutesThe Heavy Highway Vehicle Use tax is assessed on the vehicle and that's why it's so important that you report each vehicle using the Vehicle Identification Number or VIN of each separate vehicle on the Form 2290 The Heavy Highway Vehicle Use Tax does not, I repeat, does not follow the name on the registration

Truckers Can Electronically File Form 2290 Heavy Highway Vehicle Use Tax Return

Pin On Form 2290

Mar 12, 21 · You must efile your Form 2290, Heavy Highway Vehicle Use Tax Return, if you are filing for 25 or more vehicles However, we encourage efiling for anyone required to file Form 2290 who wants to receive quick delivery of their watermarked Schedule 1 With efile, you'll receive it almost immediately after we accept your efiled Form 2290Form 2290 Filing Requirements When Registering a Heavy Highway Vehicle Within 60 Days of Purchase Generally, you must file Form 2290, Heavy Highway Vehicle Use Tax Return, and pay the appropriate tax if you are registering in your name a heavy highway motor vehicle with a gross weight of 55,000 pounds or moreJul 01, 21 · Efiling for the IRS Form 2290 is now available for the 2122 tax year!

801 Highway Tax Photos Free Royalty Free Stock Photos From Dreamstime

Irs Offers Free Webinar For Heavy Vehicle Highway Use Tax Form 2290 Alabama Trucking Association Alabama Trucking Association

Pre Filing Season To Commence By June 1st For Hvut Form 2290

J J Keller 2290online Com Service For E Filing Form 2290

2

Financialinnovation What Is Heavy Vehicle Use Tax Form 2290 How To File Them

What Are The Ways To Pay 2290 Online By Efileform 2290 Medium

Learn How To Fill The Form 2290 Internal Revenue Service Tax Youtube

Form 2290 Heavy Highway Vehicle Use Tax Stamped Schedule 1

Faqs For Form 2290 Due Date Cost E Filing And More

Irs Form 2290 Truck Tax Return Fill Out Online Pdf Formswift

Form 2290 Heavy Highway Vehicle Use Tax Return

E File Irs Form 2290 Heavy Vehicle Use Tax Hvut J J Keller

Enrolled Agent Exam Prep Course Passkey Ea Review

Taxpayers Can File Form 2290 Electronically To Pay Heavy Highway Vehicle Use Tax Prescott Cpa Firm Specializing In Accounting Audits And Tax Preparation Slater Rutherford Prescott Cpas

Form 2290 Heavy Highway Vehicle Use Tax Return

Form2290filing Is The Irs 2290 E File Provider To File 229 Flickr

File 2290 Online With Huvt Form 2290 Heavy Highway Vehicle Use Tax

Fillable Online Ftb Heavy Use Tax Form Dmv Fax Email Print Pdffiller

Instructions For Form 2290 Heavy Highway Vehicle Use Tax Return Printable Pdf Download

File Irs Tax Form 2290 Online Pay Heavy Use Tax At Form 2290 Filing By Irsform2290online Issuu

The Heavy Vehicle Use Tax Form 2290 E Filing

No More Paper Reminders Will Be Mailed By Irs For Form 2290 Heavy Highway Vehicle Use Tax Return By Steve Sanders Issuu

2290 Heavy Vehicle Use Tax Hvut Baratta Enterprises 562 437 4447

24 Printable Irs Form 2290 Templates Fillable Samples In Pdf Word To Download Pdffiller

E File Irs Form 2290 With Expresstrucktax Hvut Irs Form 2290 Ifta Fuel

Office Of Highway Policy Information Policy Federal Highway Administration

Filing Tax Return 2 Internal Revenue Code Simplified

Http Doa Alaska Gov Dmv Reg Pdfs Faq Pdf

Irsnews Taxpros Can Earn 2 Ce Credits By Attending The Irs Free Webinar Understanding Form 2290 Heavy Highway Vehicle Use Tax For Details T Co Lctiqxgnog T Co Xsmrelpugm

Office Of Highway Policy Information Policy Federal Highway Administration

4lgvecsvcl2ymm

Form 2290 Online Filing Preparation 2290tax Com

Form 2290 Heavy Highway Vehicle Use Tax Return Hvut Sauri Tax

Jucf2ekrbmbfsm

The Dot Doctor Professional Services Provider Form 2290 Heavy Vehicle Usage Tax

Http Www Dmv Ri Gov Documents Forms Taxation Final 5 24 17 Form 2290 Dmv Guidance Doc W Attachments Pdf

Heavy Vehicle Use Tax And Form 2290 Drivepfs

Form 2290 Filings Heavy Highway Vehicle Use Tax Services Consultants In Kent Usa

Truck Tax Center Online Platform To E File 2290 Starts At 7 99

How To File Your Own Irs 2290 Highway Use Tax Step By Step Instructions Youtube

Heavy Vehicle Use Tax Form 2290 Federal Applications Processor

Faq On Irs Form 2290 Heavy Vehicle Use Tax Irs Tax Forms 2290

Irs To Truckers Form 2290 Is Due Aug 31 Heavy Highway Vehicle Use Tax Return Cpa Practice Advisor

How To E File Form 2290 For 21 Tax Period

Heavy Highway Tax 2290 Tax Oline Form 2290 E File Irs Form Online On Vimeo

Irs Form 2290 Online Heavy Vehicle Use Tax Hvut Return

Florida Form 2290 Heavy Highway Vehicle Use Tax Return

Form 2290 Instructions In Normal People Language

Irs Reminds Truckers Of Aug 31 Highway Use Tax Return Deadline E File Encouraged

Irs Form 2290 Instructions 21 22 What Is Form 2290

Www Cooperative Com Conferences Education Meetings Tax Finance Accounting Conference Eventmedia Page31 Bo5c form 2290 excise tax and heavy vehicles other considerations dunn Pdf

Form 2290 Heavy Highway Vehicle Use Tax Return Stock Photo Picture And Royalty Free Image Image

2290 Heavy Highway Use Tax Safety Support Services

Trucker S Form 2290 Heavy Vehicle Use Tax Kings Professional Services

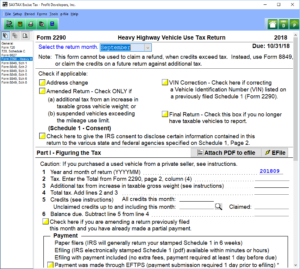

2290 Heavy Vehicle Use Tax Returnprogressive Reporting

Understanding Form 2290 Heavy Highway Vehicle Use Tax Thursday August 15 19 Passkey Ea Review

2290 Heavy Vehicle Use Tax Hvut

2290 Heavy Vehicle Use Tax Hvut Compliance Navigation Specialists

Download Instructions For Irs Form 2290 Heavy Highway Vehicle Use Tax Return Pdf Templateroller

Ez 2290 Irs Form 2290 Heavy Vehicle Taxes Home Facebook

How To Deal With Overpaid Heavy Vehicle Use Tax Form 2290

Form 2290 Filing Irs 2290 Online File 2290 Electronically

Form 2290 The Irs Heavy Vehicle Use Tax

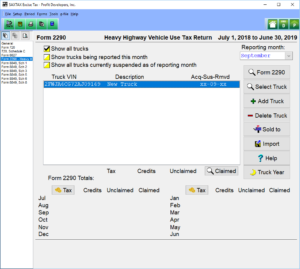

2290 Heavy Vehicle Use Tax Program Saxtax

Form 2290 Heavy Highway Vehicle Use Tax Return

Download Instructions For Irs Form 2290 Heavy Highway Vehicle Use Tax Return Pdf Templateroller

Time To Renew Form 2290 The Heavy Vehicle Use Tax

Irs Form 2290 Heavy Vehicle Use Tax Credits Peter Suess Transportation Consultant Inc

Ez 2290 Irs Form 2290 Heavy Vehicle Taxes Home Facebook

2290 Schedule 1 Federal Form 2290 Heavy Vehicle Use Tax Form By Form2290filing On Dribbble

Form 2290 Rev July Heavy Highway Vehicle Use Tax Return Fill Out And Sign Printable Pdf Template Signnow

Www Maine Gov Sos Bmv Forms Mv 2 heavy vehicle use tax 8 11 Pdf

Irs List Of 2290 Tax Filing Companies Flawed For Truckers Overdrive

2290 Heavy Vehicle Use Tax Program Saxtax

2290 Form Faq Heavy Vehicle Use Tax Irs Tax Form 2290 And 49

Irs Watermarked 2290 Proof Of Payment Schedule 1in Minutes Tax2290 Com

Qeyuyg09ypegim

Hvut Heavy Vehicle Use Tax Due August 31 Truckingoffice

コメント

コメントを投稿